PathLit: ~

TL;DR

Our API library of portfolio construction and simulation tools are for developers to build next-gen digital investment products, and for quant researchers and investment managers to run portfolio analysis.

We provide a scalable and secure API-first engine that can calculate weights, run simulations, auto-backtest and more.

Create an account, get your API key and start building!

Not sure what this is all about? - please have a look at our vision and our mission statements.

Explore quant resources

Start now with our API

We have the assets you are looking for

Portfolios are built using assets. At PathLit, we allow you the ability to build portfolios using stocks, equity ETFs and bond ETFs. Interact with our /info endpoint to find out what we cover.

Can’t find the assets you need? Contact us to request for an asset that interests you.

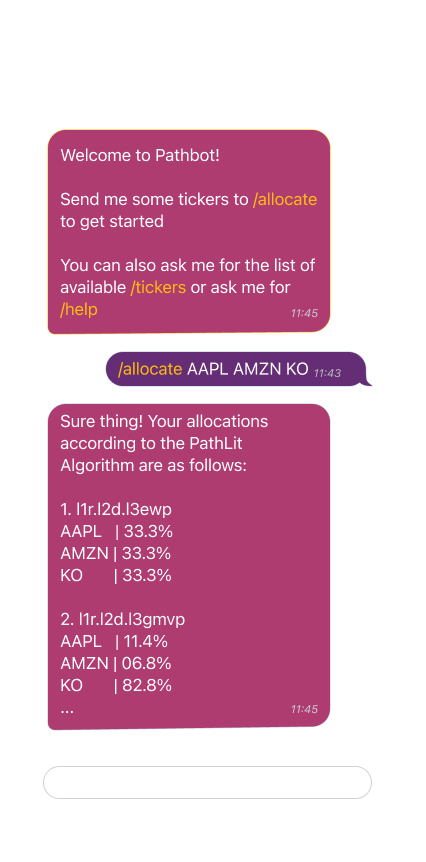

For example, you could extend your solution with a chatbot interfaced with the PathLit API to let your customers tune their choice of allocation

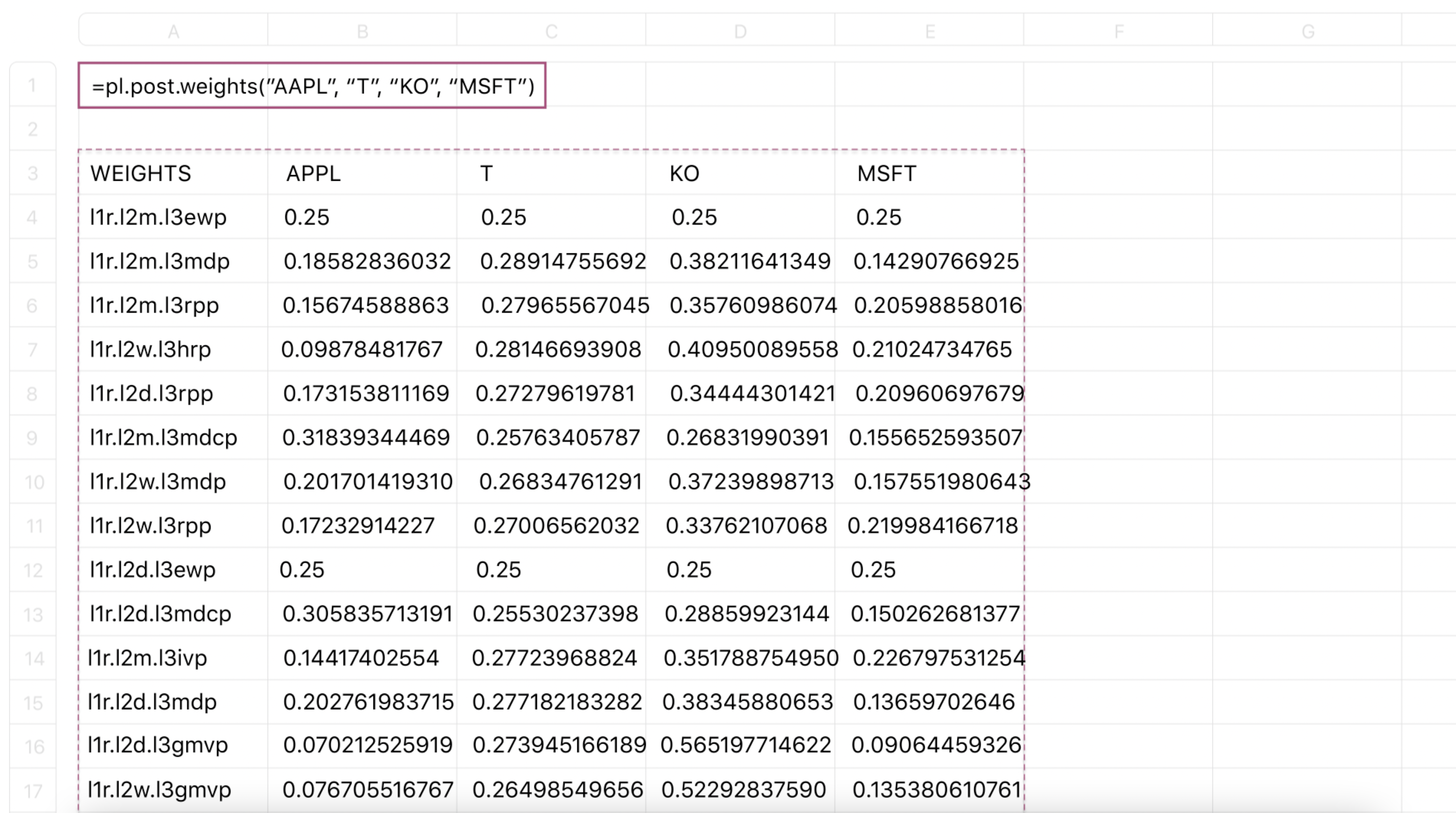

Mostly working on spreadsheet? Integrate our API and get weights computed without effort

We have the strategies you are looking for

Once you’re satisfied with our offerings of assets, interact with our /weights endpoint to construct portfolios based on 7 strategies that cover the most cited investment paradigms.

Can’t find the strategies you need? Contact us to suggest a strategy that interests you.

We have the paths your portfolio can take

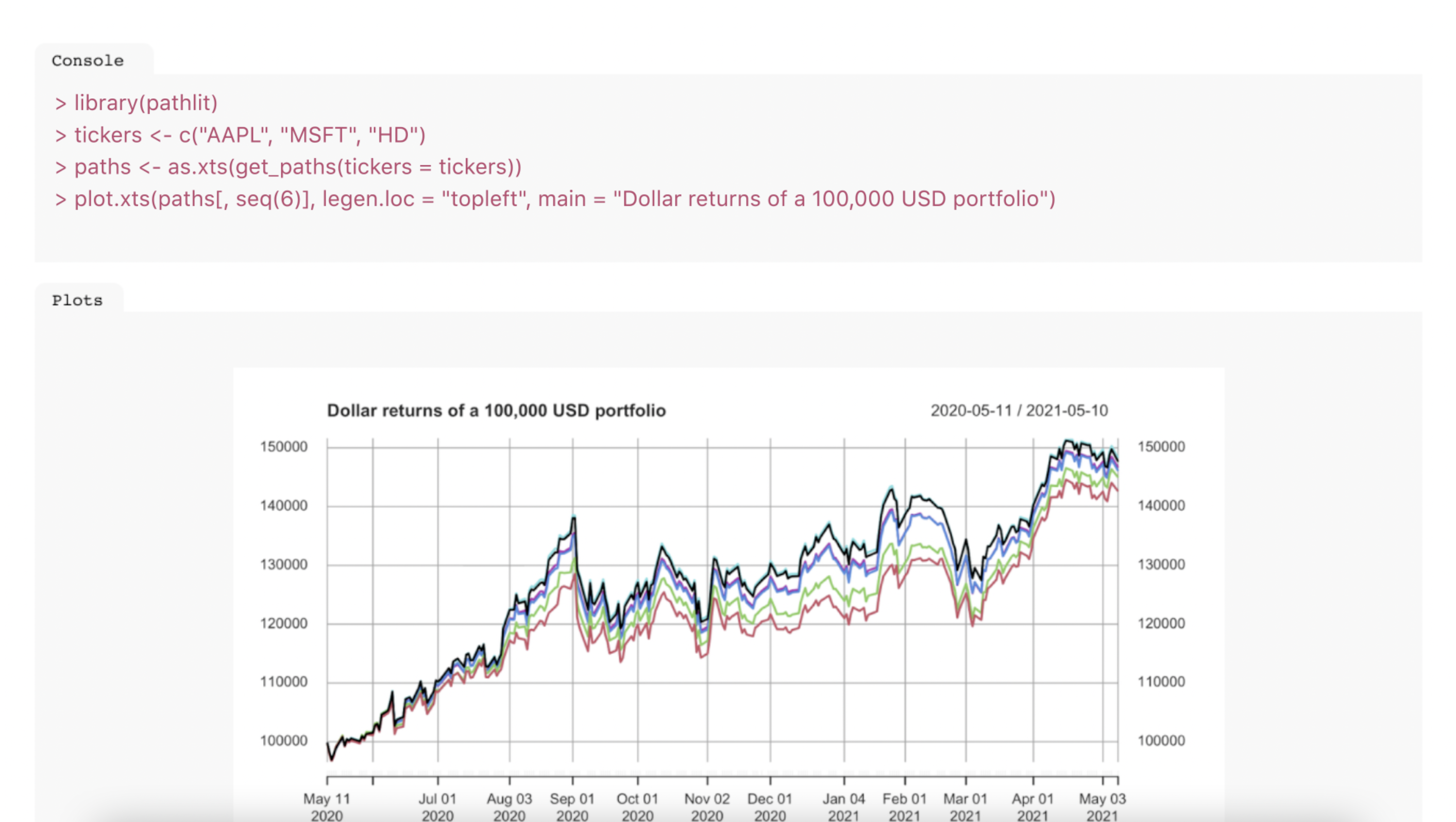

Want to see how your portfolio would have performed over the past 5 years with different strategies? Interact with our /paths endpoint to visually see the path your portfolio would have taken across various economic and stock market conditions over the past 5 years.

Can’t accept the path your portfolio takes? Contact us to suggest a path that interests you.

Using R Studio? easily interact with the PathLit API

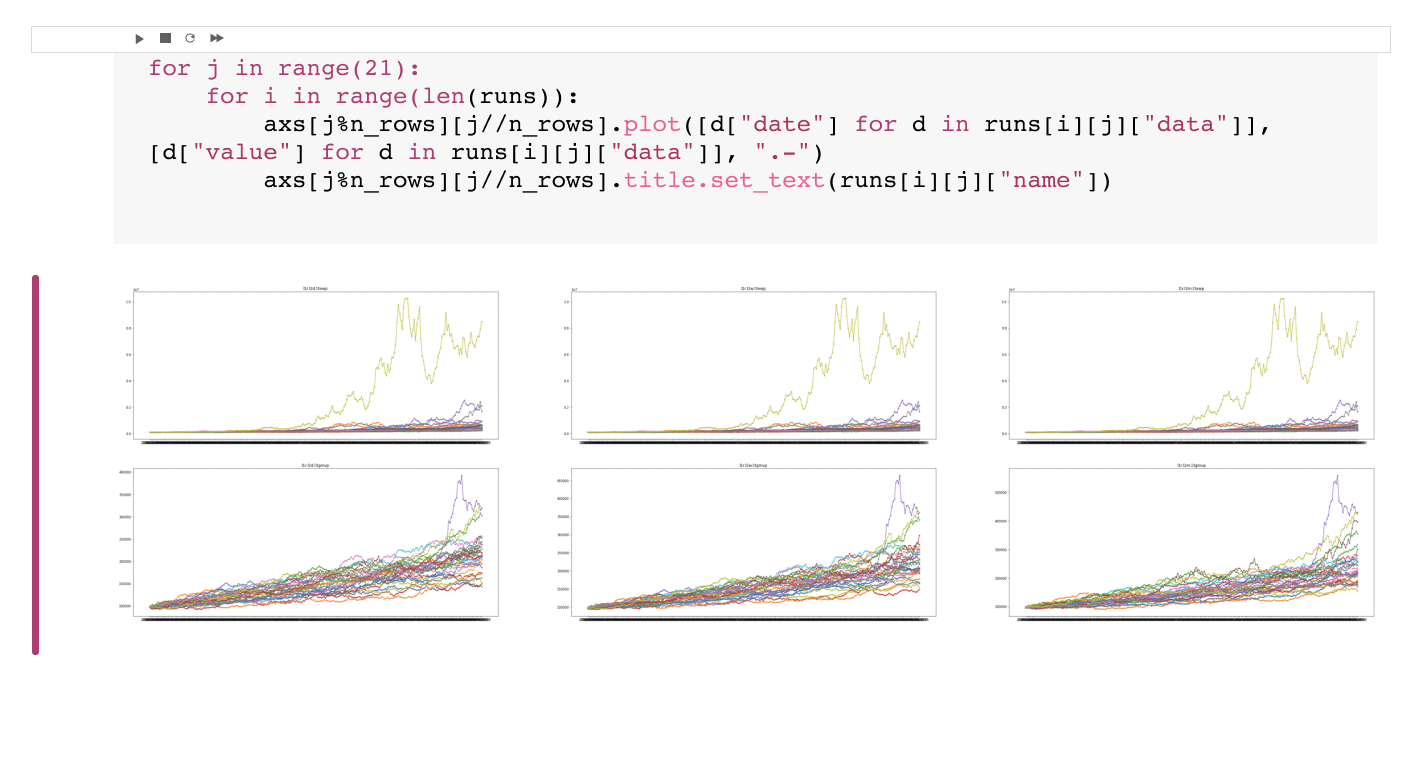

Mainly working with Python or Jupyter? we have a lightweight PyPI package to make it easier to run simulations (or paths, weigths!)

We have the simulations for your portfolio

The stock market represents one of many scenarios that has happened, but what about scenarios that could have happened over the past 5 years? Leave no stone unturned with our /simsendpoint, which simulates 10 different scenarios the assets in your portfolio may have taken over the past 5 years.

Can’t believe that the stock market takes a random walk? Contact us to suggest a simulation that would build confidence in a portfolio that you’ve built.

View our use cases

We have the assets you are looking for

Portfolios are built using assets. At PathLit, we allow you the ability to build portfolios using stocks, equity ETFs and bond ETFs. To find out what we offer, it is as simple as interacting with our /info endpoint.

Can’t find the assets you need? Contact us to request for an asset that interests you.

We have the strategies you are looking for

Once you’re satisfied with our offerings of assets, interact with our /weights endpoint to construct portfolios based on 7 strategies that cover the most cited investment paradigms.

Can’t find the strategies you need? Contact us to suggest a strategy that interests you.

We have the paths your portfolio can take

Want to see how your portfolio would have performed over the past 5 years? Interact with our /paths endpoint to visually see the path your portfolio would have taken across various economic and stock market conditions over the past 5 years.

Can’t accept the path your portfolio takes? Contact us to suggest a path that interests you.

We have the simulations for your portfolio

The stock market represents one of many scenarios that has happened, but what about scenarios that could have happened over the past 5 years? Leave no stone unturned with our /simsendpoint, which simulates 10 different scenarios the assets in your portfolio may have taken over the past 5 years.

Can’t believe that the stock market takes a random walk? Contact us to suggest a simulation that would build confidence in a portfolio that you’ve built.

View our use cases